We all think about tax day and primary goal is always, to file taxes. Many people measure their success on tax day based on how much they get back in taxes. “I got back $X so I am going to get a new <insert new must have consumer purchase>” said the happy tax filer.

We all think about tax day and primary goal is always, to file taxes. Many people measure their success on tax day based on how much they get back in taxes. “I got back $X so I am going to get a new <insert new must have consumer purchase>” said the happy tax filer.

It’s Been Your Money All Along

Keep in mind, it’s been your money all along. If you’re using the IRS as your savings account that can be acceptable, but just because you now have your money doesn’t mean you have to spend it all at once.

The better way to evaluate how well you did

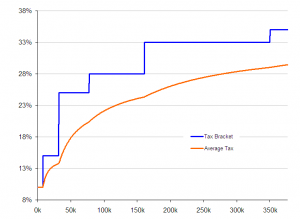

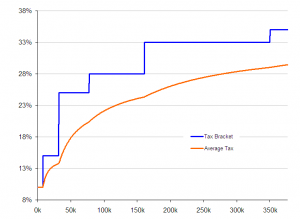

There is a much better way to evaluate how well you did on your taxes. And that’s to understand and track your effective tax rate. I am not referring to you margin tax bracket that is often discussed in the news or at cocktail party conversations, but the actual percent of taxes paid relative to Adjusted Gross Income or AGI which is total income minus some deductions and exceptions.

Do you know your effective tax rate?

In 2012, President Obama had an adjusted gross income of $608,611 and paid $112,214 in federal income tax, an 18.4 % effective tax rate.

To compute your effective tax rate

Effective Tax Rate = (Federal Income Tax Paid / Adjusted Gross Income)

To manage your annual tax liability

So, to manage your annual tax liability don’t focus on the amount of return and get lost in the debate about spending that return or not. Focus on your effective tax rate by looking how your Adjusted Gross Income is computed and what your effective tax rate is year to year.